BP PLC (LON:BP) Rating

Barclays Capital have a GBX 550.00 TP on the stock. The TP gives a potential upside of 57.14% from BP PLC (LON:BP)’s current stock price. This rating was released in a research note on 1 March.

Out of 25 analysts covering BP PLC (LON:BP), 12 rate it “Buy”, 3 “Sell”, while 15 “Hold”. This means 40% are positive. GBX 8.36 is the highest target while GBX 4.39 is the lowest. The GBX 5.45 average target is 12.64% above today’s (GBX 352.1) stock price. BP PLC was the topic in 141 analyst reports since July 22, 2015 according to StockzIntelligence Inc. Barclays Capital maintained the stock on March 1 with “Overweight” rating. Credit Suisse maintained it with “Underperform” rating and GBX 330 target price in a February 5 report. Deutsche Bank maintained the shares of BP in a report on February 23 with “Buy” rating. AlphaValue maintained the firm’s rating on February 4. AlphaValue has “Add” rating and GBX 385 price target. Finally, BNP Paribas maintained the stock with “Neutral” rating in a February 19 report.

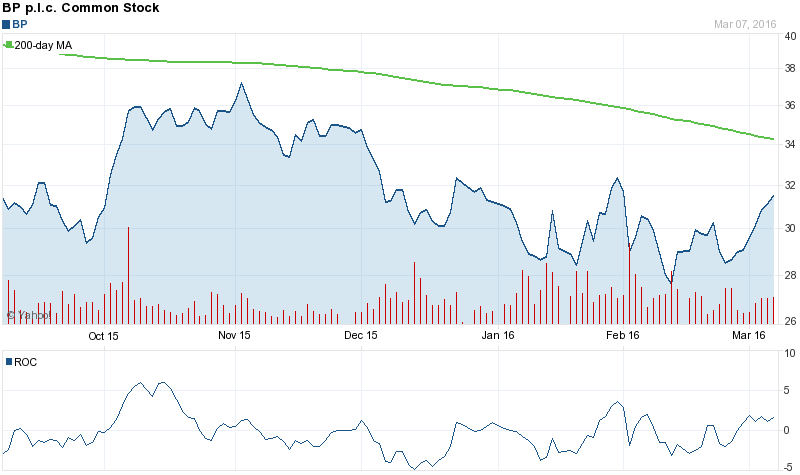

About 989,578 shares traded hands. BP plc (LON:BP) has declined 11.13% since July 31, 2015 and is downtrending. It has underperformed by 4.04% the S&P500.

Analysts await BP plc (ADR) (NYSE:BP) to reports earnings on April, 26. They expect $-0.25 EPS, down 129.41% or $1.10 from last year’s $0.85 per share. After $0.06 actual EPS reported by BP plc (ADR) for the previous quarter, Wall Street now forecasts -516.67% negative EPS growth.

BP p.l.c. is an integrated oil and gas company. The company has a market cap of 64.87 billion GBP. The Firm provides its clients with fuel for transportation, energy for heat and light, lubricants and the petrochemicals products used to make everyday items, including paints, clothes and packaging. It currently has negative earnings. The Firm operates in three business divisions: Upstream, Downstream and Rosneft.

According to Zacks Investment Research, “BP p.l.c. is the holding company of one of the world’s largest petroleum and petrochemicals groups. Their main activities are exploration and production of crude oil and natural gas; refining, marketing, supply and transportation; and manufacturing and marketing of petrochemicals. They have a growing activity in gas and power and in solar power generation. BP has well-established operations in Europe, North and South America, Australasia and Africa.”

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.