Aviva PLC (LON:AV) Rating

London: In a report issued to clients on Thursday, 17 March, HSBC kept their Hold rating on shares of Aviva PLC (LON:AV). They currently have a GBX 550.00 PT on the company. HSBC’s target indicates a potential upside of 13.01% from the company’s close price.

Out of 18 analysts covering Aviva PLC (LON:AV), 16 rate it “Buy”, 4 “Sell”, while 2 “Hold”. This means 73% are positive. GBX 690 is the highest target while GBX 417 is the lowest. The GBX 587.22 average target is 20.36% above today’s (GBX 486.1) stock price. Aviva PLC was the topic in 124 analyst reports since July 23, 2015 according to StockzIntelligence Inc. RBC Capital Markets maintained the stock on March 14 with “Underperform” rating. Morgan Stanley maintained it with “Overwt/Cautious” rating and GBX 654 target price in a March 10 report. Beaufort Securities maintained the shares of AV in a report on March 11 with “Buy” rating. Panmure Gordon maintained the firm’s rating on March 10. Panmure Gordon has “Buy” rating and GBX 660 price target. Finally, JP Morgan maintained the stock with “Overweight” rating in a March 11 report.

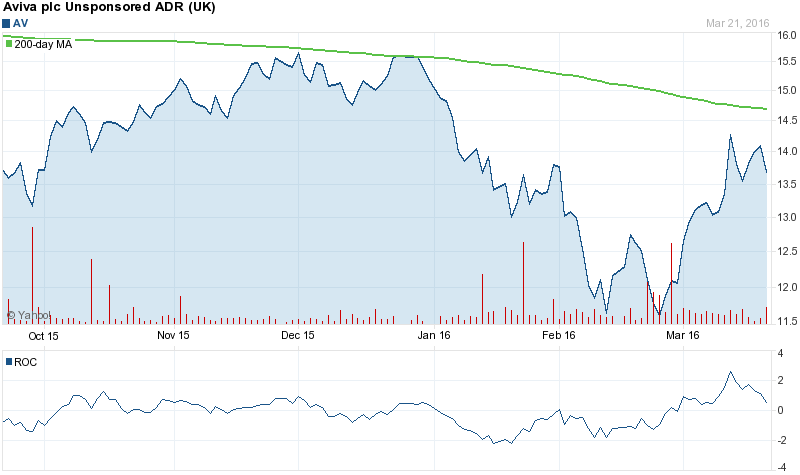

About 676,855 shares traded hands. Aviva plc (LON:AV) has declined 5.13% since August 18, 2015 and is downtrending. It has underperformed by 2.40% the S&P500.

The institutional sentiment increased to 2.19 in 2015 Q3. Its up 0.43, from 1.76 in 2015Q2. The ratio improved, as 8 funds sold all Aviva plc shares owned while 18 reduced positions. 12 funds bought stakes while 45 increased positions. They now own 17.78 million shares or 15.20% more from 15.43 million shares in 2015Q2.

Wright Investors Service Inc holds 1.54% of its portfolio in Aviva plc for 247,752 shares. Causeway Capital Management Llc owns 1.75 million shares or 0.48% of their US portfolio. Moreover, Thornburg Investment Management Inc has 0.31% invested in the company for 3.60 million shares. The Virginia-based Yorktown Management & Research Co Inc has invested 0.25% in the stock. Euclid Advisors Llc, a Connecticut-based fund reported 370,917 shares.

Aviva plc is a provider of long-term insurance and savings general and health insurance and fund management services and products. The company has a market cap of 19.68 billion GBP. The Firm operates across four lines of business: The Company’s long-term insurance and savings business, which includes a range of life insurance and savings products; general insurance, which focuses on personal and commercial lines, health insurance and fund management, which manages funds on behalf of its long-term insurance and general insurance businesses, external institutions, pension funds and retail clients. It has 21.56 P/E ratio.

According to Zacks Investment Research, “Aviva has established a competitive position in North America. In the US, the world’s largest savings market, Aviva is the leading provider of indexed annuity and indexed life insurance products. Its principal activity is the provision of financial products and services, focused on the following lines of business: long-term insurance and savings business, fund management and general insurance and health. The company’s business is managed on a geographic basis through a regional management structure based on four regions, U.K., Europe, North America and Asia Pacific. The four regions function as five operating segments as, due to the size of the U.K. region, it is split into two operating segments, U.K. Life and U.K. General Insurance, which undertake long term insurance and savings business and general insurance respectively.”

Aviva PLC - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with MarketBeat.com’s FREE daily email newsletter.