AstraZeneca PLC (LON:AZN) Rating

AstraZeneca PLC (LON:AZN) stock had its Hold Rating restate by research analysts at Beaufort Securities in a report revealed to clients on Tuesday morning.

Out of 31 analysts covering AstraZeneca PLC (LON:AZN), 16 rate it “Buy”, 3 “Sell”, while 14 “Hold”. This means 48% are positive. GBX 94.86 is the highest target while GBX 36 is the lowest. The GBX 66.57 average target is 21.68% above today’s (GBX 3908.95) stock price. AstraZeneca PLC was the topic in 201 analyst reports since July 23, 2015 according to StockzIntelligence Inc. Natixis maintained the stock on March 24 with “Neutral” rating. Nomura maintained it with “Hold” rating and GBX 4350 target price in a March 23 report. Deutsche Bank maintained the shares of AZN in a report on March 24 with “Buy” rating. Jefferies downgraded the firm’s rating on March 15. Jefferies has “Hold” rating and GBX 4350 price target. Finally, JP Morgan maintained the stock with “Neutral” rating in a March 24 report.

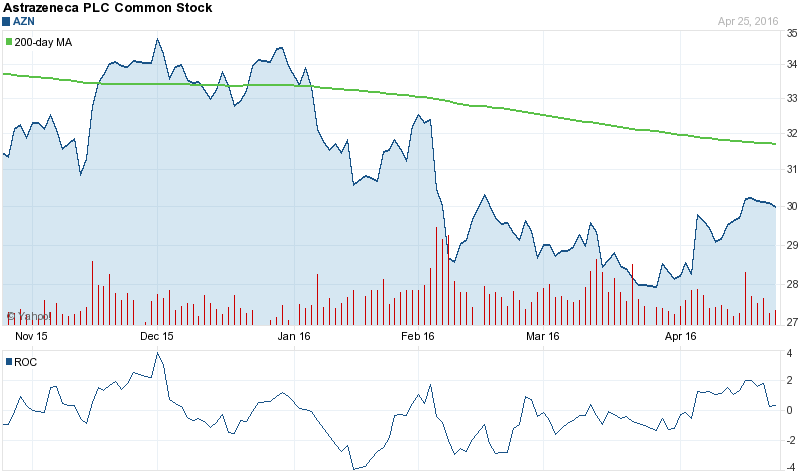

The stock decreased 1.09% or GBX 43.05 on March 24, hitting GBX 3908.95. AstraZeneca plc (LON:AZN) has declined 4.33% since August 27, 2015 and is downtrending. It has underperformed by 2.23% the S&P500.

Analysts await AstraZeneca plc (ADR) (NYSE:AZN) to reports earnings on April, 22. They expect $0.51 earnings per share, down 5.56% or $0.03 from last year’s $0.54 per share. AZN’s profit will be $1.27 billion for 13.70 P/E if the $0.51 EPS becomes reality. After $0.94 actual earnings per share reported by AstraZeneca plc (ADR) for the previous quarter, Wall Street now forecasts -45.74% negative EPS growth.

AstraZeneca PLC is a global biopharmaceutical company. The company has a market cap of 49.74 billion GBP. The Firm discovers, develops and commercializes prescription medicines for cardiovascular and metabolic diseases; oncology; respiratory, inflammation and autoimmunity, and infection, neuroscience and gastrointestinal. It has 24.71 P/E ratio. The Company’s medicines include Crestor for managing cholesterol levels; Seloken/Toprol-XL for hypertension, heart failure and angina; Iressa for lung cancer; Faslodex for breast cancer; Zoladex for prostate and breast cancer; Nexium for acid-related diseases; Seroquel XR for schizophrenia, bipolar disorder and depressive disorder, and Synagis for RSV (respiratory syncytial virus), a respiratory infection in infants.

According to Zacks Investment Research, “AstraZeneca PLC is one of the top five pharmaceutical companies in the world based on sales and is a therapeutic leader in cardiovascular, gastrointestinal, oncology, anesthesia including pain management, central nervous system (CNS) and respiratory products. They are engaged in the research, development, manufacture and marketing of ethical (prescription) pharmaceuticals and agricultural products, and the supply of healthcare services.”

AstraZeneca PLC - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with MarketBeat.com’s FREE daily email newsletter.