Amec Foster Wheeler PLC (LON:AMFW) Rating

Citigroup restate their Buy rating on Amec Foster Wheeler PLC (LON:AMFW)’s stock in an analyst note sent to investors and clients on 11 April.

Out of 16 analysts covering Amec Plc (LON:AMFW), 6 rate it “Buy”, 1 “Sell”, while 9 “Hold”. This means 38% are positive. GBX 1200 is the highest target while GBX 295 is the lowest. The GBX 541.76 average target is 23.58% above today’s (GBX 438.4) stock price. Amec Plc was the topic in 67 analyst reports since July 23, 2015 according to StockzIntelligence Inc. Citigroup maintained the stock on April 11 with “Buy” rating. JP Morgan maintained it with “Overweight” rating and GBX 619 target price in a March 11 report. Societe Generale maintained the shares of AMFW in a report on March 18 with “Buy” rating. Barclays Capital maintained the firm’s rating on March 11. Barclays Capital has “Overweight” rating and GBX 620 price target. Finally, Investec maintained the stock with “Hold” rating in a March 11 report.

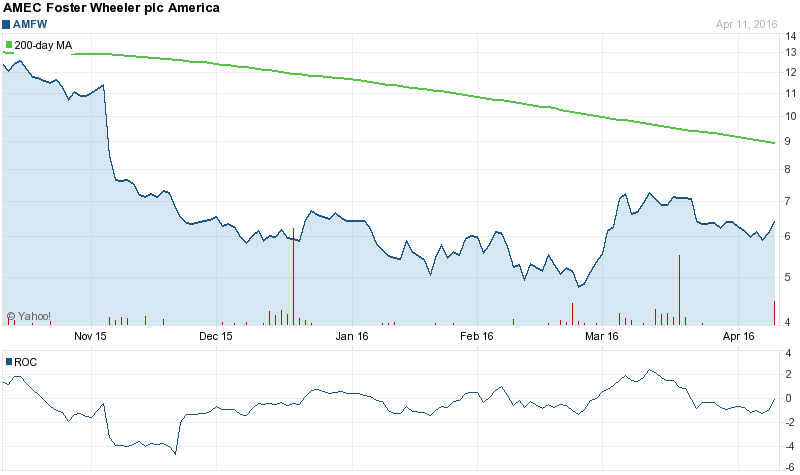

About 24,754 shares traded hands. Amec Foster Wheeler PLC (LON:AMFW) has declined 45.32% since September 9, 2015 and is downtrending. It has underperformed by 50.38% the S&P500.

Amec Foster Wheeler plc is engaged in designing, delivering and maintaining infrastructure assets across various markets that include mining, clean energy, power generation and infrastructure markets. The company has a market cap of 1.71 billion GBP. The Firm has the following operating divisions: Americas; Northern Europe & CIS; Asia, Middle East, Africa & Southern Europe ; Global Power Group, and Investment Services. It currently has negative earnings. The Company’s Americas segment is engaged in Oil & Gas, Mining, Clean Energy, and Environment and Infrastructure.

Amec Foster Wheeler PLC - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with MarketBeat.com’s FREE daily email newsletter.