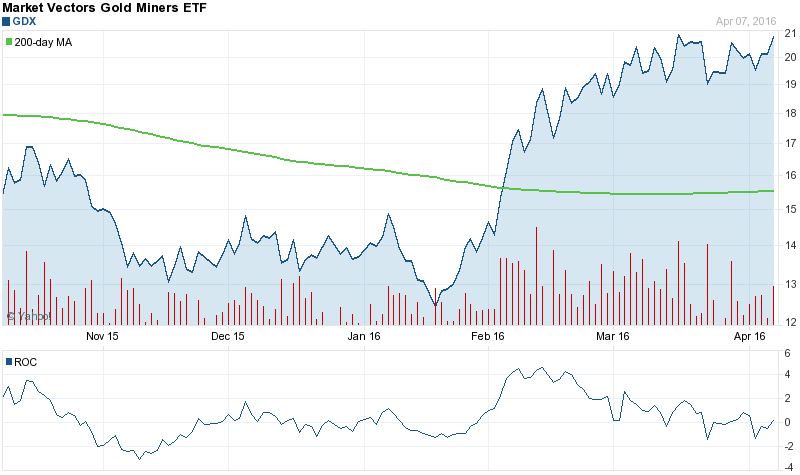

In today’s session Market Vectors Gold Miners ETF (GDX) recorded an unusually high (2,020) contracts volume of put trades. Someone, most probably a professional was a very active buyer of the January, 2018 put, expecting serious GDX decrease. With 2,020 contracts traded and 1944 open interest for the Jan, 18 contract, it seems this is a quite bearish bet. The option with symbol: GDX180119P00017000 closed last at: $3.05 or 0% . The ETF decreased 1.24% or $0.25 on March 31, hitting $19.98. It is down 46.09% since August 25, 2015 and is uptrending. It has outperformed by 35.80% the S&P500.

Market Vectors Gold Miners ETF - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with MarketBeat.com’s FREE daily email newsletter.