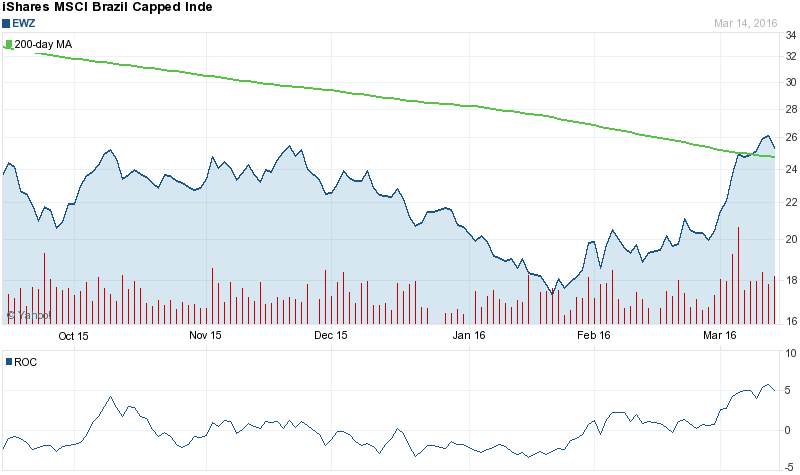

In today’s session iShares MSCI Brazil Index (ETF) (EWZ) recorded an unusually high (5,638) contracts volume of put trades. Someone, most probably a professional was a very active buyer of the May, 2016 put, expecting serious EWZ decrease. With 5,638 contracts traded and 20504 open interest for the May, 16 contract, it seems this is a quite bearish bet. The option with symbol: EWZ160520P00026500 closed last at: $1.92 or 29.4% down. The ETF increased 6.41% or $1.6 on April 8, hitting $26.56. It is down 10.94% since September 2, 2015 and is uptrending. It has outperformed by 5.88% the S&P500.

iShares MSCI Brazil Capped Index Fund , formerly iShares MSCI Brazil Index Fund, seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of publicly traded securities in the Brazilian market, as measured by the MSCI Brazil Index (the Index). The ETF has a market cap of $3.07 billion. The Index seeks to measure the performance of the Brazilian equity market. It currently has negative earnings. It is a capitalization-weighted index that aims to capture 85% of the (publicly available) total market capitalization.

iShares MSCI Brazil Index - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with MarketBeat.com’s FREE daily email newsletter.