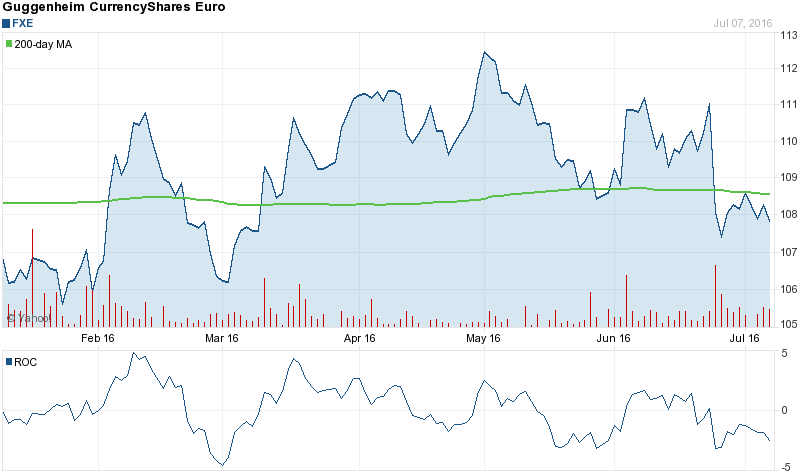

In today’s session Guggenheim CurrencyShares Euro Trust (FXE) registered an unusually high (2,146) contracts volume of call trades. Someone, most probably a professional was a very active buyer of the June, 2016 call, expecting serious FXE increase. With 2,146 contracts traded and 168264 open interest for the Jun, 16 contract, it seems this is a quite bullish bet. The option with symbol: FXE160617C00115000 closed last at: $0.52 or 8.3% up. The stock increased 0.39% or $0.43 on March 31, hitting $111.18. Guggenheim CurrencyShares Euro Trust (NYSEARCA:FXE) has declined 2.65% since August 24, 2015 and is downtrending. It has underperformed by 11.67% the S&P500.

The institutional sentiment increased to 1.2 in Q3 2015. Its up 0.34, from 0.86 in 2015Q2. The ratio increased, as 10 funds sold all Guggenheim CurrencyShares Euro Trust shares owned while 10 reduced positions. 12 funds bought stakes while 12 increased positions. They now own 4.77 million shares or 35.10% less from 7.36 million shares in 2015Q2.

Indexiq Advisors Llc holds 2.99% of its portfolio in Guggenheim CurrencyShares Euro Trust for 429,387 shares. Dsc Advisors L.P. owns 14,480 shares or 0.77% of their US portfolio. Moreover, Natixis has 0.38% invested in the company for 167,800 shares. The New York-based Lakewood Capital Management Lp has invested 0.37% in the stock. Citigroup Inc, a New York-based fund reported 1.66 million shares.

Guggenheim CurrencyShares Euro Trust, formerly CurrencyShares Euro Trust, is a grantor trust. The company has a market cap of $304.56 million. The Trust issues shares in blocks of 50,000 (a Basket) in exchange for deposits of euro and distributes euro in connection with the redemption of Baskets. It currently has negative earnings. The investment objective of the Trust is for the Shares to reflect the price of euro plus accrued interest.

Guggenheim CurrencyShares Euro Trust - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with MarketBeat.com’s FREE daily email newsletter.