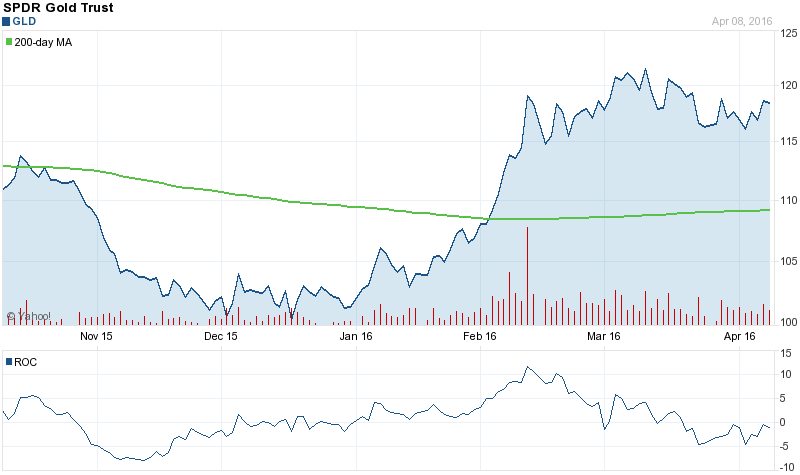

In today’s session SPDR Gold Trust (ETF) (GLD) registered an unusually high (2,049) contracts volume of call trades. Someone, most probably a professional was a very active buyer of the June, 2016 call, expecting serious GLD increase. With 2,049 contracts traded and 243974 open interest for the Jun, 16 contract, it seems this is a quite bullish bet. The option with symbol: GLD160617C00122000 closed last at: $2.39 or 5.9% down. The ETF decreased 0.15% or $0.18 on April 8, hitting $118.43. It is down 9.03% since September 2, 2015 and is uptrending. It has outperformed by 3.96% the S&P500.

SPDR Gold Trust is an investment trust. The ETF has a market cap of $32.60 billion. The Trust’s business activity is investment in gold. It currently has negative earnings. The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the expenses of the Trust’s operations.

SPDR Gold Trust - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with MarketBeat.com’s FREE daily email newsletter.